CDFI Readiness for Clean Energy Lending

In collaboration with Community Sustainability Partners, Forsyth Street Advisors, Bright Power, and Sustainable Capital Advisors, the Housing Partnership Network (HPN) CDFI Readiness Cohort has created a comprehensive framework to support CDFIs in developing clean energy lending strategies. This framework includes seven essential elements: organizational strategy, capacity assessment, customer strategy, clean energy products, capital strategy, underwriting standards, and tracking and reporting mechanisms.

CDFI Readiness Assessment Tools

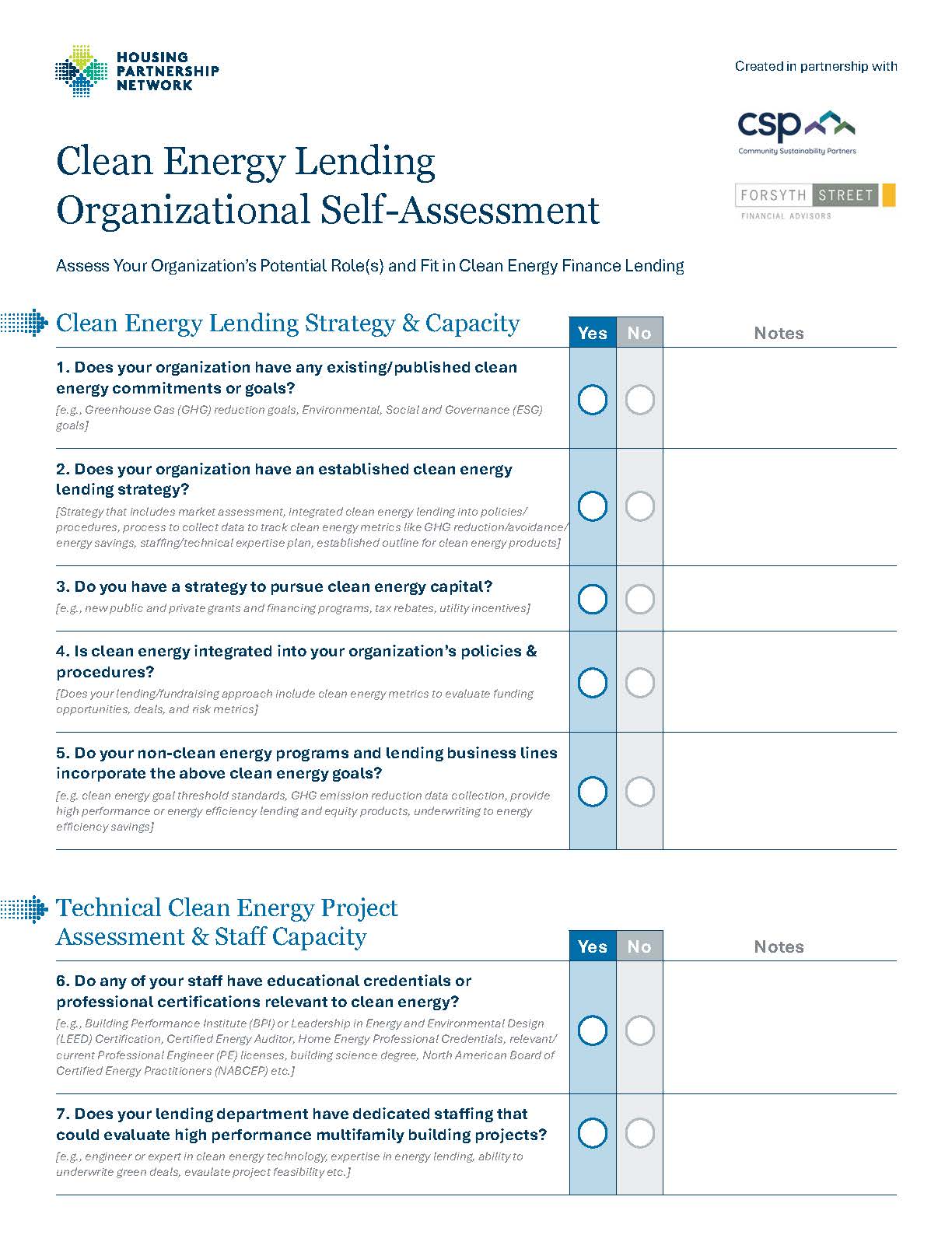

What is my organization’s role in clean energy lending?

Clean Energy Lending Organizational Self-Assessment Tool: Helps evaluate readiness and identify areas for improvement.

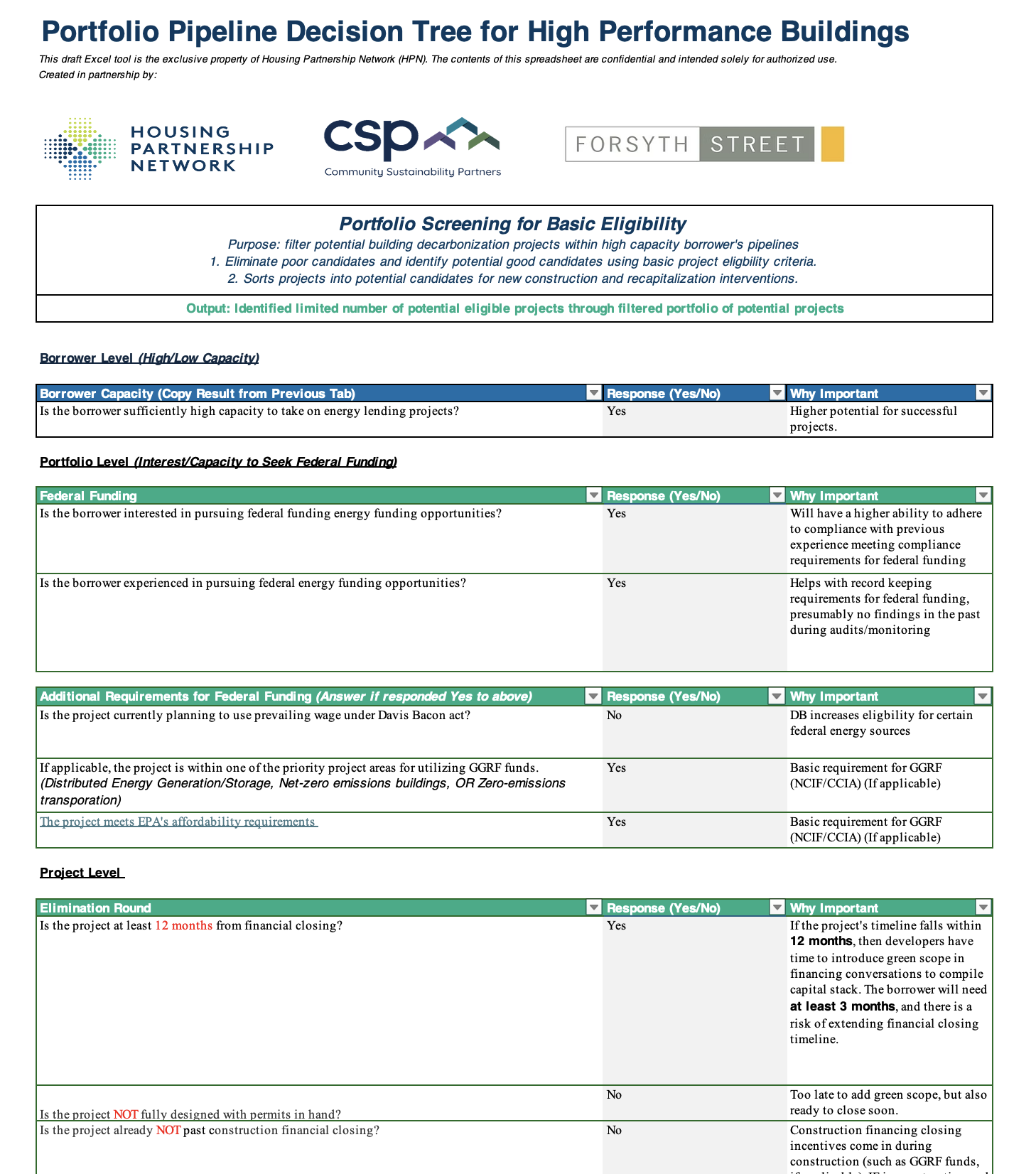

What are the best clean energy project investments in my portfolio?

Portfolio Pipeline Decision Tree for High Performance Buildings: Assists in decision-making for energy-efficient project investments.

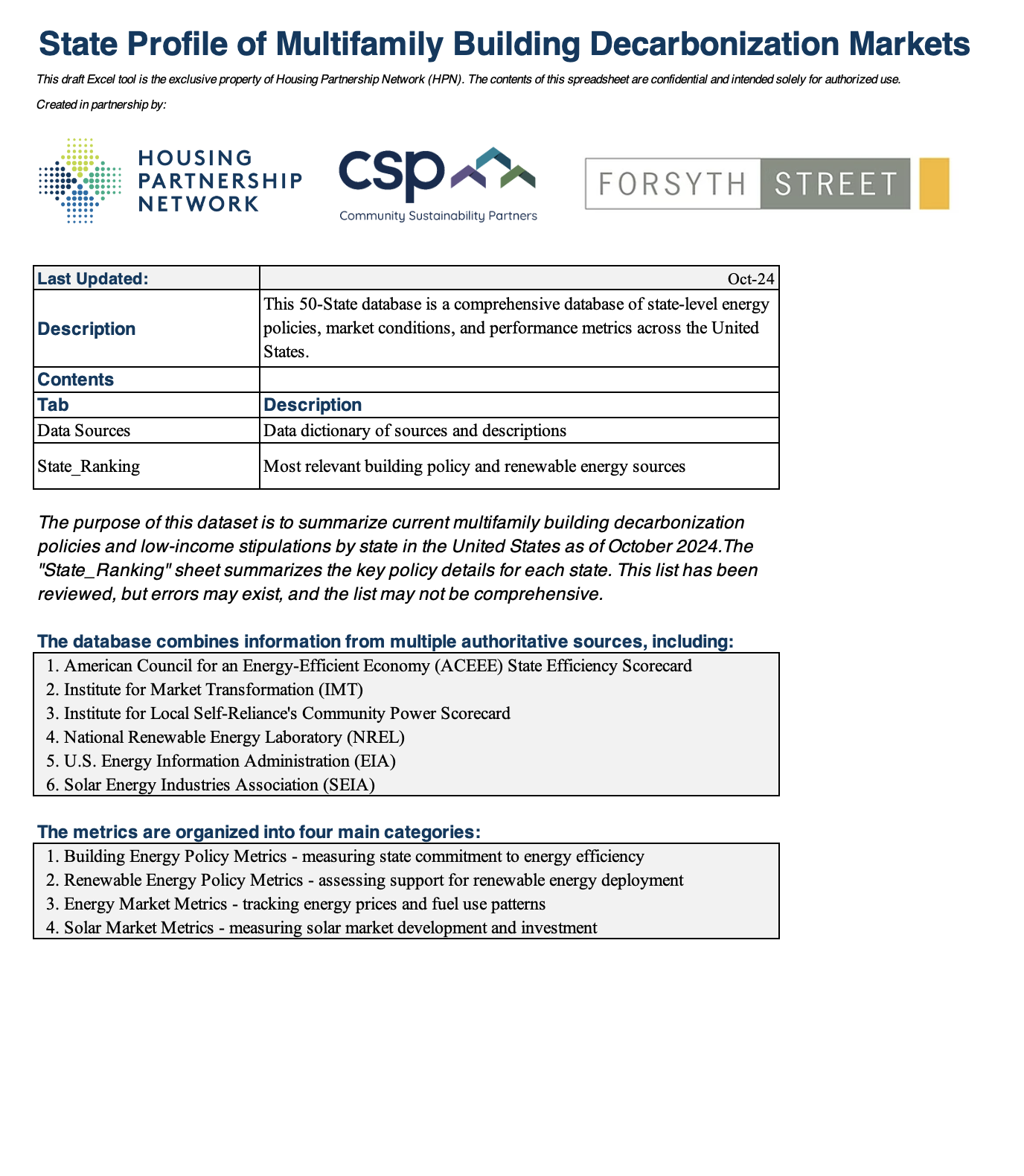

What is the regulatory environment in my state?

50-State Database: Comprehensive database of state-level energy policies, market conditions, and performance metrics.

What are the funding sources available?

Capitalization Sources for Clean Energy Lending: Provides guidance on accessing funding sources, including federal and state programs.

How can I track and report emissions reductions?

Tracking and Reporting Emissions Impacts Guide: Supports CDFIs in monitoring and reporting greenhouse gas reductions and energy savings.

Webinar: Climate Strategy Success Stories

CDFIs Advancing Climate Lending Work with Local, State, and other Support

Thursday, May 22, 2025

2:00-3:00pm EDT

This webinar session explores the success stories of CDFIs that continue their climate and clean energy programs despite the current uncertainty with federal funding sources.

During this one-hour webinar, our guest speakers shared insights into their green lending programs and the funding sources they are leveraging.

We also shared information about the lending tools we have helped develop in partnership with Housing Partnership Network that have aided community lenders in building their climate and clean energy lending strategies.

Who should watch this webinar?

This recording is valuable if you’re a community lender focused on or interested in integrating clean energy and climate lending into your product offerings.

Speakers:

- Adam Meier, Director of Green & Healthy Communities at Housing Partnership Network

- Johanna Gilligan, Deputy CEO at Homewise

- Peter Ebnet, Director of Policy & Program Development at Greater Minnesota Housing Fund

- Bryan Woll, Director of National Programs at LIIF

Webinar: Greenhouse Gas Reduction Fund (GGRF)

What are the Opportunities for Community Lenders to Use Greenhouse Gas Reduction Fund Funding?

Thursday, July 25, 2024

2:00-3:00pm EST

This webinar session, hosted by Forsyth Street Advisors and Community Sustainability Partners, illuminated the opportunities for community lenders to use funding from the Greenhouse Gas Reduction Fund’s (GGRF) programs.

The session provided detailed insights into the financial products proposed by each National Clean Investment Fund (NCIF) and Clean Communities Investment Accelerator (CCIA) grantee in their applications to the EPA and addressed ground floor questions community lenders may have about the program. Participants who may benefit from this 1 hour webinar include loan fund and depository CDFIs that are looking to begin or expand their climate lending programs using the capital from the GGRF, as well as green banks.

Forsyth Street Advisors and Community Sustainability Partners presented information from the GGRF applications of the following grantees:

National Clean Investment Fund (NCIF) – Primary Lending Capital: Climate United Fund, Coalition for Green Capital, and Power Forward Communities

Clean Communities Investment Accelerator (CCIA) – Grants for Capitalization and Capacity Building/Technical Assistance: Opportunity Finance Network, Inclusiv, Justice Climate Fund, Appalachian Community Capital, and Native CDFI Network